The construction industry in North America is heading into 2026 with increased infrastructure spending and technological advancements. Despite policy uncertainties, we have record infrastructure spending in the U.S., a recovering Canadian market, and rapid advances in technology and site safety, which make the next 12-24 months crucial for construction leaders. This blog unpacks the top 2026 construction trends and how they impact planning, bidding, risk management, and site efficiency.

To finish 2026 ahead of schedule and under budget, contractors must respond to the trends defining the construction industry.

In this blog, we'll show you:

What is the North America’s Construction Economic Outlook for 2026

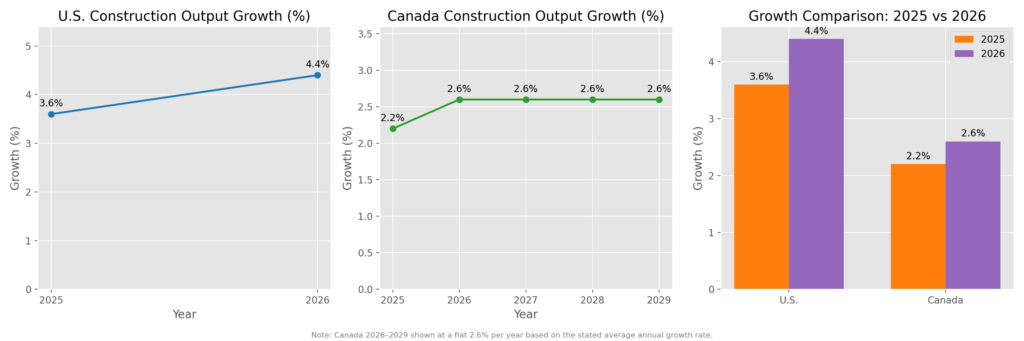

According to Deloitte’s 2026 Construction Industry Outlook, the macro-outlook lays the foundation for every decision you will make in 2026. In the U.S., overall construction output is forecast to grow about 3.6% in 2025 and 4.4% in 2026, driven by civil engineering and infrastructure work supported by the Infrastructure Investment and Jobs Act.

In Canada, the industry is expected to expand by 2.2% in 2025, then accelerate to an average annual growth rate of 2.6% from 2026 to 2029, supported by public investment in connectivity, renewables, and affordable housing.

At the same time, spending is expected to decrease in several commercial segments through 2026, especially in markets with high office vacancies and delayed private investment.

Reports from JLL and the American Institute of Architects highlight a near-flat trajectory in specific construction categories, making project selection and risk management more important than chasing volume

What this means for contractors in the U.S. and Canada:

- Expect intense competition on public and infrastructure bids, with higher prequalification thresholds.

- Choose projects tied to manufacturing, energy transition, and data centers, which are expected to outperform national averages.

- Protect margins early by pricing for volatility in materials, labor, and security.

Trend 1: Policy-Driven Pipeline and Risk

Federal and provincial/state policies are among the most significant forces defining how construction dollars flow in 2026. Dictating where the work is, how much it costs, and whether you can staff and finish it. Between federal spending programs in the U.S. and major infrastructure pushes across Canada, policy has become the single most significant driver of demand and risk heading into 2026.

In the U.S., it is coming from the following sources:

- We are still seeing the ripple effects of the Infrastructure Investment and Jobs Act, the CHIPS Act, and the Inflation Reduction Act.

- Manufacturing facilities, semiconductor plants, logistics hubs, clean energy projects, and data centers have access to funding and tax incentives.

- On the financial side, as interest rates ease off their highs, projects that were shelved during the tight money cycle are coming back to life. That means private developers are re-engaging, and the pipeline is building momentum alongside public investment.

North of the border, Canada is making similar moves.

- Federal and provincial governments are channeling funding into transportation infrastructure, renewable energy, and housing.

- Programs like the Investing in Canada Infrastructure Program and the Housing Accelerator Fund are creating massive opportunities.

Action steps for North American contractors:

- Bid on IIJA, CHIPS, IRA, and Canadian housing and infrastructure programs, such as infrastructure, manufacturing, clean energy, and housing.

- Build policy and trade risk into cost planning early. Tariffs, labor constraints, and permitting delays should be built into your estimates from day one.

- Strengthen supply chain and workforce resilience by diversifying your supplier base to avoid dependence on a single source. Additionally, develop and empower your workforce.

Trend 2: Labor Shortages and the Productivity Squeeze

Labor remains one of the defining constraints in 2026.

JLL projects that retirements, limited apprenticeship growth, and tighter immigration enforcement will continue to squeeze the skilled labor pipeline in the U.S., while Canadian construction faces similar challenges in preserving productivity amid aging workforces and rising project complexity.

The result of these labor shortages is a structural productivity problem: there are more projects and tighter schedules, but fewer experienced workers to deliver them.

Labor shortages also increase safety risk, as understaffed teams may cut corners on supervision, access control, or perimeter security to keep timelines on track.

Practical ways to respond to this top 2026 construction trend:

- Invest in workforce development. Expand apprenticeship partnerships, formalize mentoring on complex projects, and use digital tools to record institutional knowledge.

- Use technology to extend each crew member. AI-powered scheduling, reality capture, and digital twins can help smaller teams manage more work with fewer errors.

- Standardize site setups. Predefined layouts for fencing, access gates, storage zones, and safety corridors reduce onboarding time and maintain consistent productivity across sites.

Trend 3: AI, Robotics, and Data-Driven Job Sites

In 2026, AI, automation, Building Information Modeling (BIM), AI-driven scheduling, drones, and digital field management platforms are quickly becoming part of daily construction operations. Deloitte’s 2026 engineering and construction outlook notes that firms leaning into digital tools and innovation are best positioned to navigate disruptions and build value.

Where AI and robotics show up on a typical North American job site:

- Automated layout and scanning to verify work-in-place versus design.

- AI-driven scheduling tools that re-sequence tasks when delays or weather events hit.

- Robotics and drones used for hard-to-reach inspections, site documentation, and perimeter checks.

- For site logistics and security, use digital tools such as smart temporary fencing with IoT-enabled sensors, cameras, and alarms.

- Connected barriers provide real-time visibility into access attempts, after-hours activity, and high-risk zones, feeding data into centralized dashboards.

Trend 4: Modular, Prefab, and Offsite Solutions

There is renewed interest in modular and prefabricated construction across North America. The 2024 Permanent Modular Construction Report by the Modular Building Institute (MBI) shows that modular construction’s share of new construction in North America grew from 2.14% in 2015 to 6.64% in 2023. The project value increased from $3.71 billion to $14.6 billion, which shows adoption driven by faster delivery and labor efficiency.

This suggests that modular and prefabricated construction has progressed from a niche segment to a significant market presence.

|

Metric |

Value |

Source |

|

U.S. modular construction market (2024) |

~$20.3B |

FMI/Modular Building Institute (Modular Building Institute) |

|

North America modular construction market (2024) |

~$28.6B |

IMARC Group / Research and Markets (IMARC Group) |

|

Forecast growth (2025–2033) |

CAGR ~4.56% |

IMARC Group / Research and Markets (IMARC Group) |

Modular and prefabricated approaches can:

- Reduce on-site labor requirements and exposure to delays.

- Improve quality through controlled processes.

- Shrink the active-site footprint.

Implications for site planning and security:

- Tighter, smarter perimeters. With more work shifting off-site, the on-site area becomes a high-value logistics and assembly zone that must be well-protected.

- Staging and laydown changes. Deliveries may be larger but less frequent, requiring wider access gates, controlled truck routing, and modular fencing configurations that can flex with delivery schedules.

- Shorter project durations. Compressed timelines mean contractors cannot afford week-long delays while waiting for fencing or access control fixes—temporary fencing must be deployed, reconfigured, and removed quickly.

Trend 5: Sustainability and Environmental Compliance

Sustainability is increasingly being embedded in regulations, procurement criteria, and financing conditions in North America. Public and private owners alike are pushing for lower embodied carbon, more durable materials, and better waste management on construction projects.

In Canada, growth in renewable energy and regional connectivity projects is explicitly tied to climate and resilience goals. While in the U.S., infrastructure funding often includes sustainability and community impact requirements. This goes beyond the building or structural asset to include how the site is managed regarding traffic control, dust suppression, noise, perimeter safety, and public protection.

How sustainability shows up on the job site:

- The increasing use of low-carbon materials and energy-efficient systems is becoming more prevalent.

- More scrutiny is being placed on waste and logistics, including how often materials move on and off site.

- There is a growing demand for reusable, long-life temporary fencing systems.

For temporary fencing specifically, innovations such as modular designs that reduce waste, and durable, reusable bases align with both sustainability goals and cost control.

Trend 6: Site Security, Temporary Fencing, and Safety Compliance

With more expensive equipment, materials, and technology on-site, security is becoming a top concern for contractors and owners across North America. Theft, vandalism, and unauthorized access can eat into already-thin margins, delay schedules, and increase insurance premiums, especially on high-profile infrastructure, energy, and data center projects.

OSHA and ANSI guidelines in the U.S. require contractors to maintain safe environments and segregate hazardous areas, and proper fencing is a key part of compliance. OHS, Provincial regulators enforce similar expectations in Canada, where perimeter control is critical to protecting the public near urban projects.

Modern temporary fencing trends defining 2026:

- Smart, IoT-enabled fencing includes sensors, cameras, and alarms integrated into fence panels, providing real-time alerts that reduce the need for 24/7 human guards.

- Enhanced safety features. Anti-trip bases, reflective coatings, and clearly marked access gates reduce accidents for workers and pedestrians around active sites.

- Modular systems. Panels that can be quickly moved support phasing, lane shifts, and changing site boundaries without compromising security.

Trend 7: Cost Volatility and Smarter Procurement

Material and equipment pricing, influenced by global trade fragmentation, tariffs, and shifting demand patterns, will affect the construction industry in 2026. JLL warns of a delayed cost shock in 2026 as more deferred projects restart into a still-constrained supply environment, putting upward pressure on materials and logistics.

North American contractors are responding by tightening procurement strategies and looking for partners who offer predictability, flexibility, and value beyond the lowest unit price. This includes multi-project supply agreements, early locking in of key materials, and outsourcing non-core components like fencing, security hardware, and access control.

Procurement tactics for 2026:

- Bundle services where it makes sense by partnering with vendors who can supply and install temporary fencing, gates, barriers, and related safety products across multiple regions.

- Standardize specifications. Define standard fence heights, base types, gate configurations, and accessories so estimators and PMs can price and plan quickly.

- Leverage data. Use past-project data on theft incidents, safety infractions, or schedule impacts to justify investing in higher-grade fencing or monitored systems.

Trend 8: Urban Density and Community Expectations

Many of North America’s most active construction markets are located in dense urban environments. Projects in these settings are under scrutiny from residents, businesses, and regulators, making site presentation and public safety essential.

In these markets, temporary fencing serves as both a security measure and a public-facing interface. There are also other tools, such as privacy screens, to reduce theft and liability, improve safety and compliance, and control public perception.

Ways that Fencing can help:

- Separate work zones from sidewalks, bike lanes, and traffic.

- Provide clear, safe pedestrian routes during construction.

- Create opportunities for branded wraps, project information, or community messaging.

Contractors who manage their perimeters carefully reduce complaints, minimize accidents, and build better relationships with city officials.

How to Turn The Top 2026 Construction Trends into a Competitive Edge

Audit your job sites.

- How are your fencing layouts, access points, and safety corridors?

- Are you exposed to theft, safety incidents, or complaints?

Choose quick wins.

- Upgrade fencing at high-risk or high-visibility sites first.

- Pilot smart fencing or monitoring on a flagship infrastructure or manufacturing project.

Align with your growth strategy.

- If you are targeting more public infrastructure work, ensure your safety, security, and compliance documentation is best-in-class.

- If you are leaning into modular and prefabricated, redesign site logistics with compact, flexible perimeters in mind.

Choose partners, not just products.

- Work with vendors who understand North American regulations, can support both U.S. and Canadian job sites, and offer scalable solutions for multi-site rollouts.

Conclusion

Adapting to these Top 2026 construction trends will be necessary to maintain a competitive edge and leverage opportunities. However, it will require contractors to review their operations to ensure safety, security, and efficiency. Consider how AI, modular, sustainability, cost volatility, and labour shortages affect your business, and how you can leverage these trends to make 2026 a successful year.

As you plan for 2026, review your temporary fencing needs and partner with providers who can scale as you grow. Temporary fencing and site security intersect with risk management, compliance, community relations, and project delivery. Changing how you plan, procure, and manage your perimeters will lead to fewer headaches, better margins, and build trust with your clients.

Next steps

- Review your 2026 project pipeline and flag high-risk sites that need upgraded fencing and security.

- Book a consultation with your preferred temporary fencing provider to provide ideal perimeter solutions.

- Educate your teams on how site security decisions impact risk, schedule, and profitability during toolbox talks.

Please fill in the form below to subscribe to our newsletter and get these blogs directly to your inbox.

Sources:

American Institute of Architects. (2025, January 26). Softness in construction spending is predicted through 2026. https://www.aia.org/about-aia/press/softness-construction-spending-predicted-through-2026-consensus-construction. Atradius. (2025, January 22). Regional construction industry trends 2025/2026. https://group.atradius.com/knowledge-and-research/reports/industry-trends-regional-construction-industry-trends-2025-2026. U.S. Department of Transportation. (n.d.). Infrastructure Investment and Jobs Act. https://www.transportation.gov/infrastructure-investment-and-jobs-act. Congress.gov. (n.d.). CHIPS and Science Act (H.R. 4346). https://www.congress.gov/bill/117th-congress/house-bill/4346. U.S. Department of Energy. (n.d.). Inflation Reduction Act (IRA). https://www.energy.gov/lpo/inflation-reduction-act-2022. Government of Canada. (n.d.). Investing in the Canada Infrastructure Program. https://housing-infrastructure.canada.ca/plan/icp-pic-INFC-eng.html. Canada Mortgage and Housing Corporation. (n.d.). Housing Accelerator Fund. https://www.cmhc-schl.gc.ca/professionals/project-funding-and-mortgage-financing/funding-programs/all-funding-programs/housing-accelerator-fund. Business Wire / Financial Post. (2025, December 1). Canada construction industry report 2025: Output to expand by 2.2% this year, recover further through 2029. https://financialpost.com. Deloitte. (2025, November 12). 2026 engineering and construction industry outlook. https://www.deloitte.com/us/en/insights/industry/engineering-and-construction/engineering-and-construction-industry-outlook.html. Exploding Topics. (2021, March 30). 11 construction industry trends to watch (2025–2028). https://explodingtopics.com/blog/construction-industry-trends. JLL / Construction Owners Association of America. (2025, November 17). JLL releases 2026 U.S. construction outlook. https://www.jll.com/en-us/insights/2026-us-construction-perspective. Mobile Fencing. (2025, October 26). Why temporary fencing is essential for every construction site. https://mobilefencingne.com/temporary-fencing/construction-site-safety/. Modular Building Institute. (2024). Permanent Modular Construction Report 2024. https://www.modular.org/industry-analysis/. The Birmingham Group. (2025, December 3). 2026 construction trends: Revolutionary changes defining the industry. https://thebirmgroup.com/construction-trends-in-2026-revolutionary-changes-shaping-the-industry/. Business Wire. (2025). Canada construction industry report 2025: Output to expand by 2.2% this year [Press release]. https://www.businesswire.com/news/home/20251202765574/en/Canada-Construction-Industry-Report-2025-Output-to-Expand-by-2.2-This-Year-Supported-by-Rising-Investments-in-Both-Residential-and-Non-residential-Construction—Forecast-to-2029—ResearchAndMarkets.com. RHC Site Services. (2025). The future of temporary fencing: Innovations to watch for in 2025. https://rhcsiteservices.com/the-future-of-temporary-fencing-innovations-to-watch-for-in-2025/. Financial Post. (2025). Canada construction industry report 2025: Output to expand by 2.2% this year [Business Wire News Release]. https://financialpost.com/pmn/business-wire-news-releases-pmn/canada-construction-industry-report-2025-output-to-expand-by-2-2-this-year-supported-by-rising-investments-in-both-residential-and-non-residential-construction-forecast-to-2029-researchandmarket